Renters Insurance in and around Pittsburgh

Renters of Pittsburgh, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Pittsburgh Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or space, renters insurance can be the right decision to protect your possessions, including your lamps, bicycle, microwave, video games, and more.

Renters of Pittsburgh, State Farm can cover you

Renters insurance can help protect your belongings

Agent Cindy Brophy, At Your Service

Renting is the smart choice for lots of people in Pittsburgh. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance may take care of water damage to walls and floors or an abrupt leak that causes water damage, what about the things you own? Finding the right coverage helps your Pittsburgh rental be a sweet place to be. State Farm has coverage options to correspond with your specific needs. Thank goodness that you won’t have to figure that out alone. With empathy and fantastic customer service, Agent Cindy Brophy can walk you through every step to help you set you up with a plan that guards the rental you call home and everything you’ve invested in.

There's no better time than the present! Call or email Cindy Brophy's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Cindy at (412) 221-2775 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

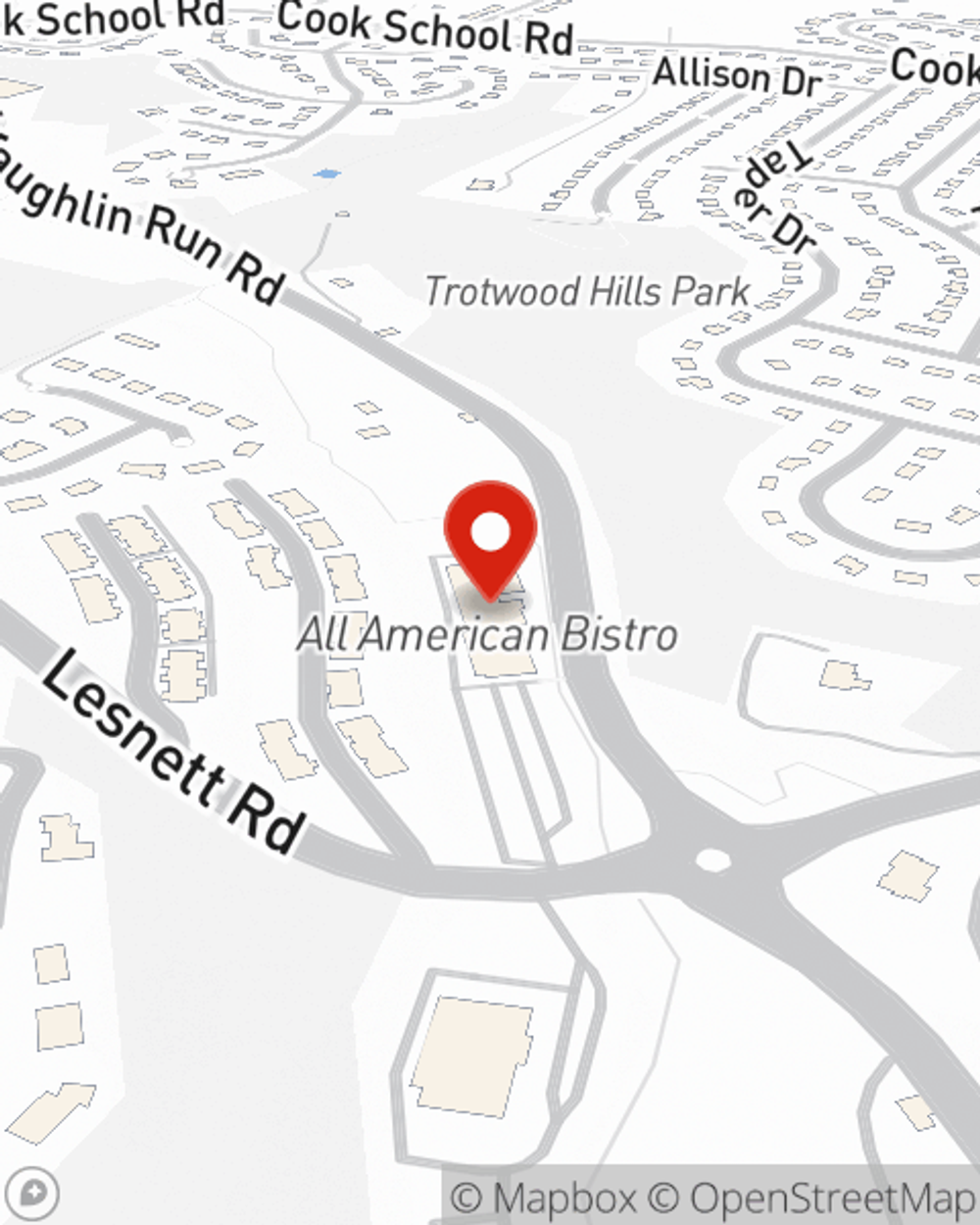

Cindy Brophy

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.